JPMorgan Chase has created a new global role overseeing all junior bankers in an effort to better manage their workload after the death of a Bank of America associate in May forced Wall Street to examine how it treats its youngest employees.

The firm named Ryland McClendon its global investment banking associate and analyst leader in a memo sent this month, CNBC has learned.

Associates and analysts are on the two lowest rungs in Wall Street’s hierarchy for investment banking and trading; recent college graduates flock to the roles for the high pay and opportunities they can provide.

The memo specifically stated that McClendon, a 14-year JPMorgan veteran and former banker who was previously head of talent and career development, would support the “well-being and success” of junior bankers.

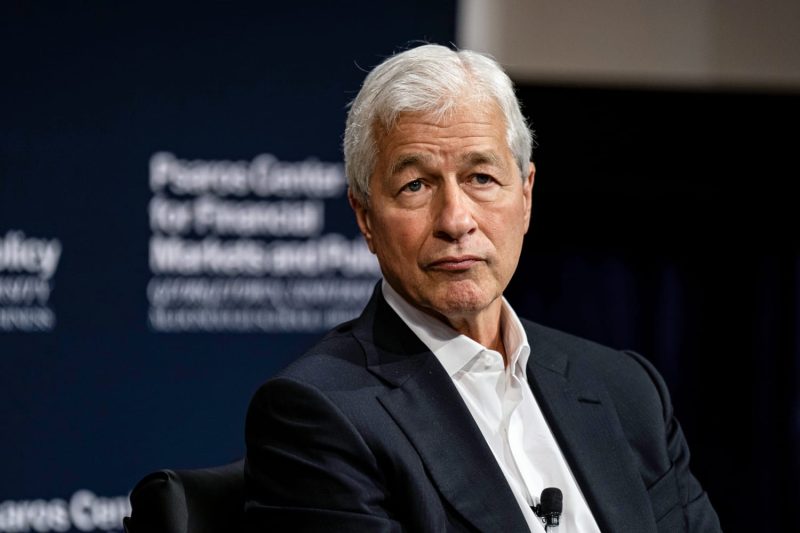

The move shows how JPMorgan, the biggest American investment bank by revenue, is responding to the latest untimely death on Wall Street. In May, Bank of America’s Leo Lukenas III died after reportedly working 100-hour weeks on a bank merger. Later that month, JPMorgan CEO Jamie Dimon said his bank was examining what it could learn from the tragedy.

Then, starting in August, JPMorgan’s senior managers instructed their investment banking teams that junior bankers should typically work no more than 80 hours, part of a renewed focus to track their workload, according to a person with knowledge of the situation.

Exceptions can be made for live deals, said the person, who declined to be identified speaking about the internal policy.

Dimon railed against some of Wall Street’s ingrained practices in a financial conference held Tuesday at Georgetown University. Some of the hours worked by junior bankers are just a function of inefficiency or tradition, rather than need, he indicated.

“A lot of investment bankers, they’ve been traveling all week, they come home and they give you four assignments, and you’ve got to work all weekend,” Dimon said. “It’s just not right.”

Senior bankers would be held accountable if their analysts and associates routinely tripped over the policy, he said.

“You’re violating it,” Dimon warned. “You’ve got to stop, and it will be in your bonus, so that people know we actually mean it.”